Definition of ‘Micro Cap’

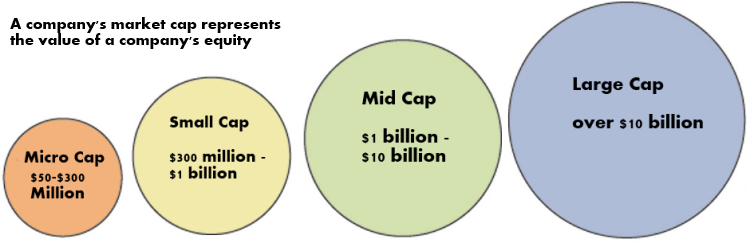

Micro cap is a term referring to publicly traded companies which have a market capitalization between approximately $50 million and $300 million.

More on Micro Cap Stocks

Micro cap stocks have a greater market capitalization than nano caps, and less than small, mid, and large cap stocks.

Microcap companies typically have limited assets. Microcap stocks tend to be low priced and trade in low volume compared to larger cap stocks. However, companies that have a bigger market cap do not automatically have higher stock prices than those companies with a smaller market cap.

Typically, stocks with a bigger market capitalization are less risky and offer smaller potential returns. The smaller the market capitalization, the riskier the investment and the greater for potential gains as well as potential losses.

Where Do Microcap Stocks Trade?

Many micro cap stocks are traded over-the-counter with their prices quoted on the OTCBB or the OTC Markets (Pink Sheets). More established and transparent micro cap stocks are listed on the NASDAQ or American Stock Exchange (AMEX).

You can find micro cap stocks that trade on the following:

- NASDAQ – Has a number of microcap stocks, especially technology, healthcare, and biotech stocks.

- NYSE AMEX – Has a decent number of micro cap stocks listed but not as many as the NASDAQ

- OTCBB – Features a variety of microcap stocks. Many trading between $0.01 & $1 per share.

- OTC Markets (formerly Pink Sheets) This market is divided into 3 tiers:

- The OTCQB is for companies registered with the SEC

- The OTCQX is for companies who aren’t registered with the SEC but do report their audited financials to the OTC Markets.

- The OTC Pink Markets is for companies who may or may not disclose any information to the public. These are the most speculative of the three tiers.

What else should You Know About Micro Cap Stocks?

Micro cap stocks are also sometimes referred to as “penny stocks” and are small companies with little or no earnings. Micro cap stocks can trade at any share price, but are usually traded at less than $5 per share.

While some microcap stocks may be legitimate investment opportunities, these stocks are by nature very risky business. Some microcap stock are a target for pump and dump schemes and can easily be manipulated.

Always investigate these type of stocks before you invest in them. And remember, not all low priced stocks are a bargain!

Some micro cap stocks that trade over OTC or Pink Sheets are thinly traded with very little volume and it can be difficult to buy or sell shares. Micro cap stocks tend to move faster and are more volatile than larger cap stocks, have huge swings of up and down.

What attracts people to micro cap stocks is the notion that a small investment of just $500 can multiply many times over, compared to a slow-moving large cap stock. Micro cap stocks offer you the chance to double, triple, quadruple your money.

If a stock is at .10 cents and rises by ten cents, you will have made a 100% return. Many investors think that micro cap stocks are a rapid way to double your money.

Sure, this is true in some cases, but people tend to see only the upside of micro cap stocks, while forgetting about the downside. A 10 cent stock can just as easily go down by 5 cents and lose half its value or more and may never get back to that level again.

The point is, whenever investing in micro cap stocks, make sure you do extensive research and understand what you are getting into. And if you are trading penny stocks you should always put in a tight stop loss.

How Do I Get Information On a Microcap Stock?

Depending where a particular microcap stock is trading it can sometimes be difficult or easy to get information on the company. The best place to start is the SEC’s website.

Other websites for information are: