The dividend yield is a percentage figure that investors use to determine what a stock pays out to shareholders in dividends.

This figure is used among value investors or for those investors looking for dividend income. They use the dividend yield as a guide when in search of high dividend paying stocks.

Typically, well-established companies with earnings tend to payout dividends and have a higher percentage dividend yield. When a company pays a dividend it is a way to attract new investors and keep current shareholders happy. Many investors like the steady income associated with dividends.

Whereas, a younger smaller company may offer little to no dividend. This may because the company doesn’t have the earnings yet to pay out a dividend or may prefer to reinvest its capital to help the company grow even more.

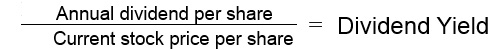

DIVIDEND YIELD FORMULA – HOW DIVIDEND YIELD IS CALCULATED

Dividend yield is simply the annual dividend divided by the current share price, expressed as a percentage.

Calculated as:

Annual dividend per share ÷ stock’s price per share = Dividend Yield

For example, if a company has an annual dividend of $0.50 and the current share price is $20.00, then the stock would have a 2.5% yield ($0.50 ÷ $20.00 = 0.025).

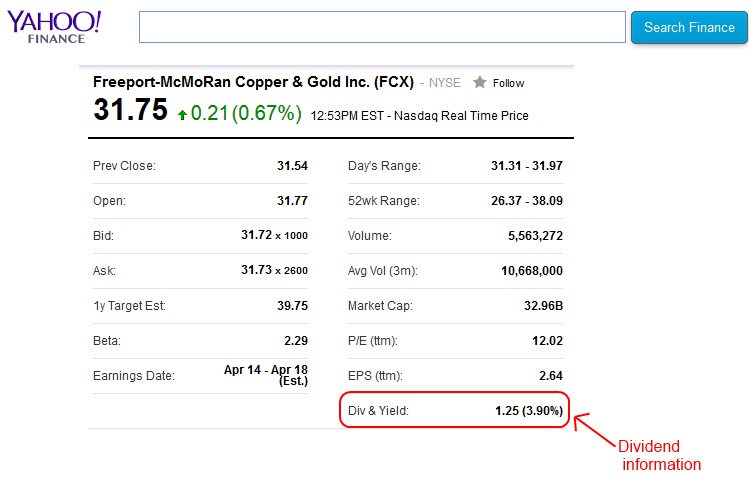

DIVIDEND YIELD SAMPLE

Freeport-McMoRan Copper & Gold Inc. (NYSE:FCX) currently pays out $0.3125 per share dividend each quarter to shareholders. Since there are four quarters in a year, that equals to $1.25 annually ($0.3125 x 4 = $1.25).

FCX’s stock price currently trades at 31.75 per share.

Now to figure out the current dividend yield you simply take the annual dividend, which is $1.25, and then divide that by the current stock price of 31.75.

$1.25 ÷ 31.75 = 0.039

The math comes out to be a 3.9% dividend yield.

If FCX’s stock price were to drop in price then the dividend yield will increase. Conversely, if FCX’s stock price were to increase the dividend yield would decrease. Also, the dividend yield can decrease or increase if the company were to cut or increase its dividend.

Most stock-quote systems such as Google Finance, Yahoo Finance or your online broker automatically displays the dividend yield when getting a stock quote.

WHAT IS A GOOD DIVIDEND YIELD

A higher dividend yield has been considered to be desirable among many investors. Value investors or dividend investors are often in search of higher yielding dividend stocks to add to their portfolio.

Stocks with a high dividend yield can be a good investment, especially if the stock is held over a long period as the investor will continue to receive a dividend payout. In many cases, stocks that offers a high yield are often a safer bet than growth stocks.

However, investors need to be cautious because not all high-dividend-yield stocks are winners. Just because a stock currently has a high dividend yield doesn’t necessarily mean the stock is a good buy.

A high dividend yield could mean the company is not doing so well and the stock has dropped, which has given the stock a high dividend yield. And if the company has bad fundamentals it could mean that a dividend cut will most likely take place in the future and could cause the stock price to drop even more.

A good way to avoid these “dividend traps” is to always look at the company’s fundamental and technical picture to get a better idea on how well the company is performing.

Another thing investors should check is how are the earnings compared to the annual dividend rate. If earnings have fallen below the dividend, then there is no way a company can keep paying out their dividend and the dividend will most likely be cut in the future.