The Price to Book Ratio (P/B ratio) is a valuation ratio used by investors which compares a stock’s per-share price (market value) to its book value. It is also sometimes known as a book to market ratio or price to book value ratio.

The P/B ratio basically puts a value on how much investors are paying for every dollar of assets owned by the company. So essentially it gives an idea on how much the company would be worth if the company was broken up and sold everything off.

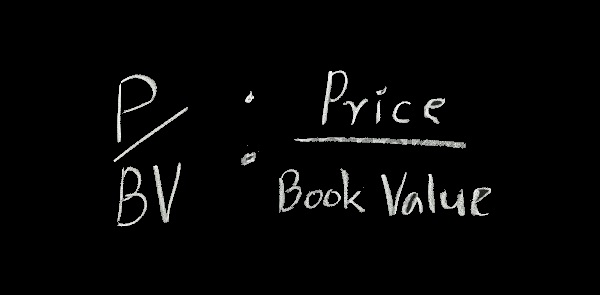

HOW THE P/B RATIO IS CALCULATED – FORMULA

The price to book value ratio can be calculated in one of two ways:

1) The company’s current stock price is divided by the book value per share (book value divided by the number of outstanding shares).

2) The other way to calculate the formula is to take the company’s market capitalization and divide it by the company’s total book value from its balance sheet.

Calculated as: Share Price / Book Value = P/B ratio

In some calculations intangible assets and liabilities are removed from the equation as their value is significantly more subjective and often has no resale value.

PRICE TO BOOK VALUE EXAMPLES

A company named XYZ is trading at $5 per share, with a book value per share of $2.25. The company is said to have a price to book of 2.22 (5 ÷ 2.25 = 2.22).

Another company named ABC has a market capitalization of $200 million and lists total book value of $125 million, for a price to book ratio of 1.6 (200 ÷ 125).

Company PQR has a market capitalization of $10 million and lists total book value at $4 million, but $1 million of that is in intangible assets. While the price to book value may be listed as 2.5 (10 million / 4 million), the price to tangible book value is 3.33 (10 million / (4 – 1 million) ).

WHAT IS A GOOD P/B RATIO?

Typically, a lower P/B ratio means that the stock is undervalued relative to the equity of the company. However, a low P/B ratio could also mean that something is fundamentally wrong with that particular company.

A higher ratio could indicate the firm is overvalued relative to the equity of the company.

The price to book ratio is frequently used among value investors. Typically, P/B ratios of less than or equal to 3.0 catches the attention of value investors.

However, a P/B ratio that meets these criteria can mean one of two things:

1) The stock is selling at a discount to its fair value. This could be a great buying opportunity.

2) Something could be fundamentally wrong with the company and this stock should be avoided.

Many experienced investors are able to correctly decipher the difference. The price to book ratio should never be used as the only measure when it comes to evaluating a company.

MORE ON THE PRICE TO BOOK RATIO

As stated above, the price to book ratio essentially gives investors an idea on how much the company would be worth in the case of liquidation.

The price to book value ratio is most useful for comparing companies within asset-intensive businesses but service-oriented businesses or those without substantial property, plant and equipment typically have little book value and trade at very high P/B multiples.

For example, a mining company such as Freeport-McMoRan (NYSE:FCX) will trade at a much lower P/B ratio compared to Facebook (NASDAQ:FB) because a mining company is a more asset-intensive business.

As with most ratios, be aware that this varies by industry. The best comparisons are within the same industries and against a company’s historical ratios.