3D printing has been a hot industry lately and many 3D printing stocks have been making some nice moves over the past few months.

3D printing is a new breakthrough technology that looks like it could change the world.

So, is this technology the next big thing? Will 3D Printing Change the World? No one knows for sure, but with the rise of this technology the last few years it sure looks like 3D printing could revolutionize the manufacturing industry.

Some industry experts have said that 3D printing may help return manufacturing to the United States and a 21st-century industrial revolution could happen right here in America. Some say it is “the next trillion dollar industry.

3D printing can eliminate the advantages of low cost mass produced production runs. Can you say goodbye to made in China products?

3D printing is a revolution because it allows you to instantly print parts and entire products no matter where in the world you are – eliminating the need for costly time consuming models.

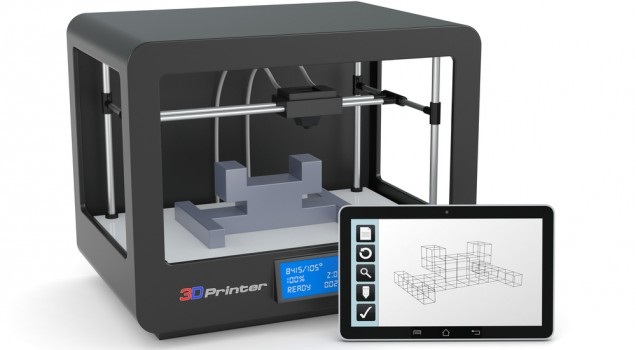

For those not familiar with 3D printing, lets take a look at what this technology can do. With 3D Printing you can take a digital file and turn it into a physical item.

A 3-D printer, which has nothing to do with paper printers, creates an object by stacking one layer of material on top of another. Typically plastic or metal is used.

A variety of physical items can be produced, some of the most common items include machine parts, jewelry, furniture, medical casts (dental crowns), recreational goods, and there has even been reports that human organs are starting to be produced with this awesome technology.

This short video from PBS is a good overview of how the technology works.

As you can see from the video, this technology is absolutely amazing! 3D Printing has an undeniably wide range of possibilities which could profoundly change our world.

So, how can an average investor profit from this revolutionary technology? Well, there is a couple 3D printing companies in operation right now, which are publicly traded and can be invested in to capitalize off of this growing technology.

Many of these 3D printing stocks have surged recently and could be set for even bigger gains in the years to come. There is a couple companies that trade on the NYSE and NASDAQ, and there is also a couple that trade over-the-counter. Lets take a look at some of these 3D printing stocks.

1. 3D Systems Corporation (NYSE: DDD)

3D Systems Corporation (DDD) trades on the NYSE. The company is the industry leader and largest company of the 3D printing stocks. The company currently has a market cap of around $2 billion.

3D Systems engages in the design, development, manufacture, marketing, and servicing of 3D printers and related products, print materials, and services.

3D Systems Corporation (DDD) has seen its stock price double the past year. The stock has a 52 week high of 47.99 and low of 14.45. DDD is currently trading at $32 per share.

The company has had double-digit year-over-year percentage revenue growth for the past four quarters. Over that period, revenue has grown by an average of 51.8%. The biggest boost came in the first quarter when revenue increased 62.7% year-over-year.

2. Stratasys, Ltd. (SSYS)

Stratasys trades on the NASDAQ under the ticker symbol: SSYS. Just like 3D Systems Corporation, the company is an industry leader in the 3D printing industry. The company currently has a market cap of around $2.5 Billion.

Stratasys Ltd. offers manufacture and sale of three-dimensional (3D) printers and materials that create prototypes and manufactured goods directly from 3D CAD files or other 3D content. Its 3D printers are based on patented fused deposition modeling (FDM) and PolyJet inkjet-based technologies.

Stratasys’s equipment is starting to become widely used for production of finished goods in low-volume manufacturing. Systems range from affordable desktop 3D printers to large production systems for direct digital manufacturing.

Stratasys, the world’s largest 3-D printer company, announced this week it has completed its merger with Objet, the privately held but substantial 3-D printer manufacturer.

The company has a P/E ratio of 75.6, above the S&P 500 P/E ratio of 17.7. Stratasys has a market cap of $2.46 billion and is part of the industrial goods sector and industrial industry.

3. ExOne Co. (XONE)

ExOne Co. just recently started trading publicly and made its public debut on February 7, 2013.

The company trades on the NASDAQ under the ticker symbol XONE. This small-cap company currently has a market cap of $350 million. The stock is currently trading at $28 per share and has traded as low as 23.50 and a high of 33.60 .

The ExOne is a global provider of 3D printing machines and related products to industrial customers. ExOne’s business primarily consists of manufacturing and selling 3D printing machines and printing products to specification for its customers using its in‐house 3D printing machines. The company offers pre-production collaboration for its customers through the Production Service Centers located in the U.S., Germany and Japan. Besides selling printing machines, the company offers associated products, replacement parts, training and technical support.

4. Organovo Holdings Inc (ONVO)

![]()

Organovo Holdings Inc. trades over-the-counter under the ticker ONVO.

ONVO is a very interesting company and looks like it has alot of potential. The company designs and creates functional human tissues using 3D bioprinting technology. The Company has developed and is commercializing a platform technology for the generation of three-dimensional (3D) human tissues that can be employed in drug discovery and development, biological research, and as therapeutic implants for the treatment of damaged or degenerating tissues and organs.

ONVO currently has a market cap of $176 million. Its stock is currently trading at 3.70 and has seen a wild ride the past year with a 52 week high of 10.90 and a low of 1.49

5. Cimatron Ltd. (CIMT)

![]()

Cimatron Ltd. isn’t quite a pure play in 3D stocks, but the company is partly involved. CIMT develops software that aids in 3D printing through its two product lines CimatronE and GibbsCAM.

The company has also recently announced that it has created a 3D Printing Advisory Board, which is to explore opportunities in 3D printing. The company is looking to find opportunities to take a bigger role in the 3D printing industry. This is why the company can not be ignored as a play on the rising technology of 3D printing

Cimatron trades on the NASDAQ under the ticker CIMT and has a low market cap of just $70 million. CIMT is a low volume stock and is currently trading at $7.60.

The Bottom Line

There is no doubt that 3D printing a revolutionary technology and will change the manufacturer industry. However, I would wait for a pull-back in some of these 3D printing stocks before I would buy them. Most of them have gotten way too ahead of themselves due to hype.

New investors will probably want to sit on the sidelines while those already in may want to take some profit off the table and get back in at more favorable valuations.